If you are either very poor or very wealthy, being savvy with your money as you age doesn’t matter much. If you are very poor, the government, through Medicaid and other social programs, will take care of you. If you are very wealthy, you have the funds to pay for the care you need. The typical Adventist usually falls in the middle since they have been faithful with tithe and offerings but have also been taught to save and be good stewards. In today’s turbulent financial times, being “as wise as a serpent and as innocent as a dove” has truly never applied more than it does now.

This is why Florida, Georgia-Cumberland, and Kentucky-Tennessee conferences’ Planned Giving and Trust Services departments have teamed up to bring members Savvy Seminars for Seventh-day Adventists. These one-hour webinars occur approximately every other month. Following is a brief recap of some of the seminars.

Probate Avoidance and Asset Protection Planning

This webinar featured attorney Geoff Hoatson of Family First Firm in Winter Park, Fla. He presented ways to spare families the expense and aggravation of probate while at the same time protecting those assets from potential creditors, including Medicaid. He explained how a few minutes of strategy can save loved ones thousands of dollars and many hours probating an estate.

Staying Safe from Identity Theft and Cyber Crime

Retired FBI Special Agent Jeff Lanza shared more than two dozen tips on how to keep safe from those who would steal identities or assets through cyber crime. Some of his best tips:

- If you are 62 years of age or older, go to www.ssa.gov and set up an online social security account before a cyber criminal does it.

- Freeze your credit report with the four major credit reporting agencies.

- Use passphrases instead of passwords.

- For a more secure connection to the web, access it through your data connection on your cell phone rather than from public Wi-Fi.

- Hover over e-mail addresses with your cursor to see who is really sending you that e-mail.

Year-end Tax Strategies

Betty Hass of Munroe Haas P.A. is a CPA. She shared several tips on how to take advantage of legal tax strategies that help minimize tax obligations:

- Rather than taking a required minimum distribution (RMD) from your IRA, being taxed on that amount, and risking an increase in your Medicare premiums, consider asking the IRA administrator to send the RMD directly to the church or charity of your choice. You never receive the money, so you do not have to claim it as income on your 1040.

- Now that the standard deduction for personal income taxes is over $25,000 for a married couple, consider bunching your itemized deductions one year and taking the standard deduction the next year. Contact Hass or your own CPA for an explanation of bundling.

- Make sure donations for the current year are dated and postmarked by Dec. 31.

Retirement Money Blunders and How to Fix Them

Rey Descalso of Privada Wealth Management taught how to sidestep the biggest retirement pitfalls that seem to trip up so many retirees. He also offered solutions to mitigate blunders that may have already occurred:

- Allocate retirement savings into three buckets: liquid, stable, and growth, so you have funds available in a down market without realizing actual losses.

- Prepare for the fragile decade.

- Try to avoid taking social security too early.

- Don’t go it alone. Get the appropriate financial advice.

Special Invitation To Readers

Being able to offer these and other webinars has been a blessing. The goal of the Planned Giving and Trust Services Department is not simply to provide wills and other estate planning documents for our members. We strive to empower our members with knowledge and strategies that allow them to provide for their loved ones, avoid catastrophic financial mistakes, support the Lord’s work, and have peace of mind.

You are invited to join us, from the comfort of your home, for our upcoming webinars, and please contact your Conference planned giving and trust services personnel to see how they can be a blessing to you and your family.

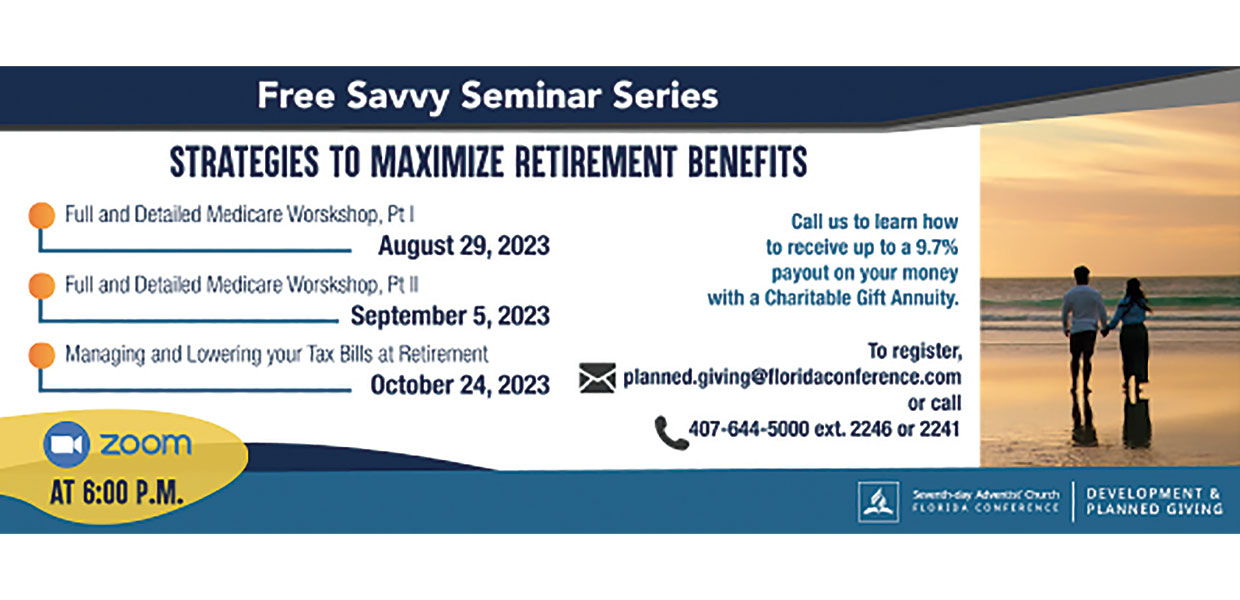

These special Savvy Seminars for Seventh-day Adventists are only available on ZOOM. Pre-registration is required and is available online at planned.giving@floridaconference.com or contact planned giving and trust services by using the telephone number listed on the schedule below.

Florida | May 2023

Comments are closed.